先進的で効果的な パートナーシップの 最大化を実現します

Partnerizeは、企業と企業、企業とインフルエンサーやアフィリエイターなどのパートナーシップを最大化し、世界の主要企業がより効率的な戦略を生み出すことを可能にするソフトウェアプラットフォームとサービスを提供しています。

マーケティングは絶え間なく変化しています

マーケティングのダイナミクスは変化を遂げており、購入における主導権がマーケターから消費者に移っているため、カスタマージャーニーにおける遍在性に対する重要性が高まっています。

Advertising costs with Facebook and Google aren’t sustainable.

マーケティングのアトリビューションを一元的に把握したい

ブランドの安全性を維持することは、私にとって非常に重要です。

最初のセールスおよびマーケティングチャネルへの過度の依存は、費用がかかり、持続が困難になります。

営業レバレッジを得ることが唯一有効な方法であると私たちは考えます

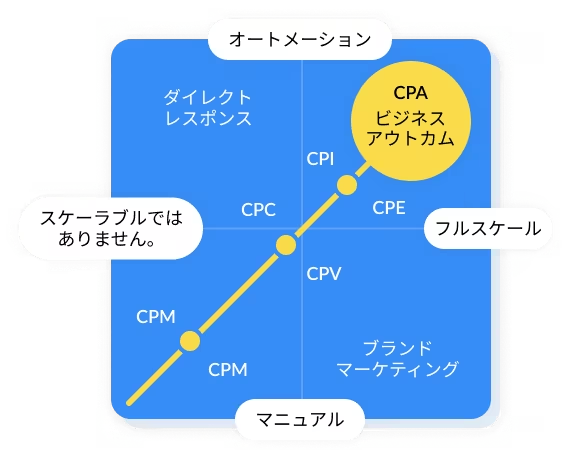

営業レバレッジを生み出し、持続的で収益性の高い成長を促進するには、自動化、規模、成果に基づく価格設定モデルを使用したパートナーシップの組み合わせが必要です。

パートナーシップをプロフィットセンター(利益)に変える必要があります。

パートナーシップチャネルについて知っておくべきこと

企業の80%は、収益性の高い成長を促進するためにパートナーシップに頼っています

広告出稿をしているパートナーの84%は、企業と繋がるためにパートナーシップチャネルを利用しています

CMOの65%は、2021年のパートナーシップの予算増加に言及しています

なぜパートナーシップが企業の秘密兵器となり得るのか?

現在、消費者の価値観の変化やチャネルの多様化などにより、検索から購入まで、チャネル、メディア、デバイスの全てにおいて、ターゲット観客に付き添う必要性が高まってきています。

パートナーシップは、成果報酬型モデルに基づいて、カスタマージャーニー全体を通して大規模に遍在する唯一のチャネルと言えます。

貴社はカスタマージャーニー全体を通して届けたいターゲットと接点を持つことができていますか?

パートナーシップのための

より良いソリューションをご案内します。

従来のネットワークモデルを離れ、手動のタスクとスプレッドシートの代わりに、収益性の高い成長をもたらすパートナーシップの自動化を奨励します。

Partnerizeは、バーティカル(業種)を問わず、エンドツーエンドのテクノロジーとフレキシブルなサービスを通じて、プライマリチャネルへの質が高く、スケーラブルな補助金を求めるマーケターの成長を手助けするパートナーマーケティング企業です。

当社のテクノロジーを見る

当社のサービスを見る

Partnerizeは、人々が何十年にもわたって求めてきたアフィリエイトおよびパートナーシップソリューションを提供します

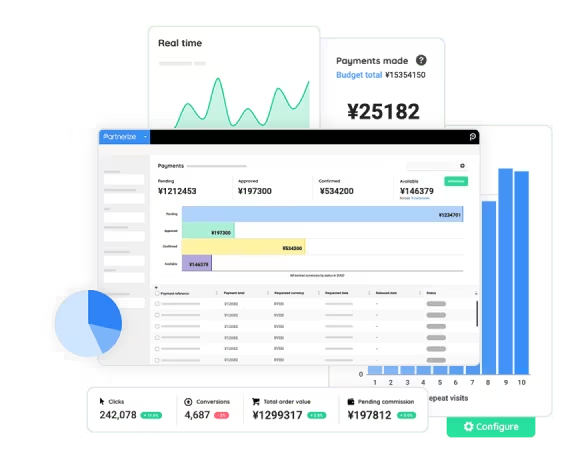

Partnerizeのプラットフォームは、検索、採用、最適化、支払い、企業保護、不正防止機能を備える完全自動化のプラットフォームです。 Partnerizeのプラットフォームの特徴は、このカテゴリで唯一の社内サポートプログラムを含むサービスを提供しており、パートナーシップマーケティングのライフサイクル全体をすべて「貴社内」で管理することができることです。

Partnerize は、2022 年の Channel Incentive Management Analyst Report で強力なパフォーマーに選ばれました

B2B2C ブランドおよびパートナー向けのパートナーシップ自動化のリーダーである Partnerize は本日、最近発表されたレポート、The Forrester Wave™: Channel Incentive Management, Q1 2022 で「強力なパフォーマー」として認定されたことを発表しました。Channel Incentives Management Wave は、 「ボリューム リベート、新規顧客ボーナス、販売実績インセンティブ ファンド (SPIF)、市場開発の戦略的な組み合わせを展開することにより、パートナー グループの収益、リーチ、またはミックスを改善することを目的とした CIM ソリューションの評価に広範囲に焦点を当てています。資金(MDF)、組み込まれた人員、および活動ベースの価値創造報酬…」レポートは、「…パートナー化は、ほとんど非トランザクションのB2B2Cチャネルインセンティブの新しい(そして重要な)分野をリードしています…

1800以上の名だたるブランドがPartnerizeを選択する理由

Partnerizeは、リテール、旅行、金融サービス、D2C、サブスクリプションサービス、エンターテインメントを含む全ての主要なバーティカル(業種)がパートナーシップマーケティングプログラムを立ち上げ、管理、スケールできるようにサポートするソフトウェアとサービスを提供しています。

GoProは、PepperjamとPartnerizeの統合製品により、ガイド付きのサービスと革新的なテクノロジーの恩恵を受けています。

Partnerizeのプラットフォームが提供するエンドツーエンドの管理機能は、詳細なアナリティクスとスムーズな支払いを可能にし、グローバルパートナーとの提携をスムーズにしてくれました。今では当社の事業を成長させるトレンドを理解してもらう不可欠なツールとなっています。

当社のチームは、プログラムの完全な管理とプラットフォームでの着実な成長を確実にするためにガイド付きサービスを選択しています。

伴走しながらの学習と継続的なサポートにより、移行に関するリスクがなくなり、パートナーチャネルの立ち上げ時間を短縮できました。

パートナーシップには様々な形があります。 Partnerizeはあなたに合ったソリューションを提供します。

マーケター

消費者向けの商品、サービス、ソリューションをオンラインで提供しています。

パートナー

パートナーチャネルで成果を出すことで販売手数料を得ています。

代理店

各種の企業様に代わってパートナーシップを管理しています。